Irr Sensitivity Analysis

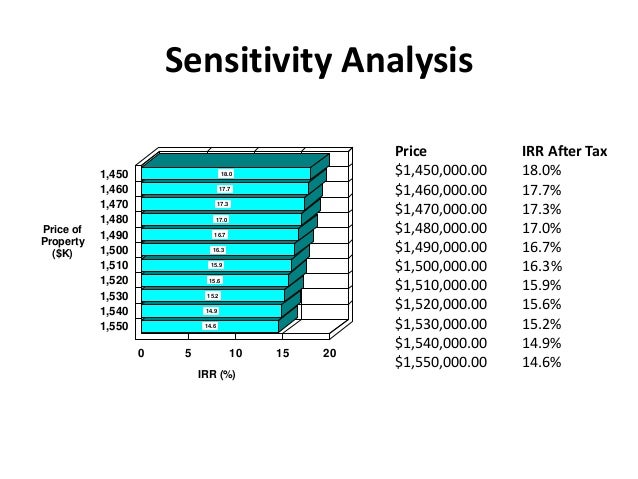

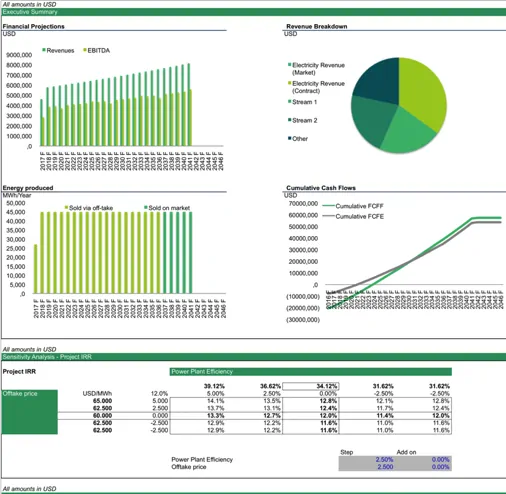

Internal Rate of Return (IRR) The Internal Rate of Return is a good way of judging an investment.The bigger the better!

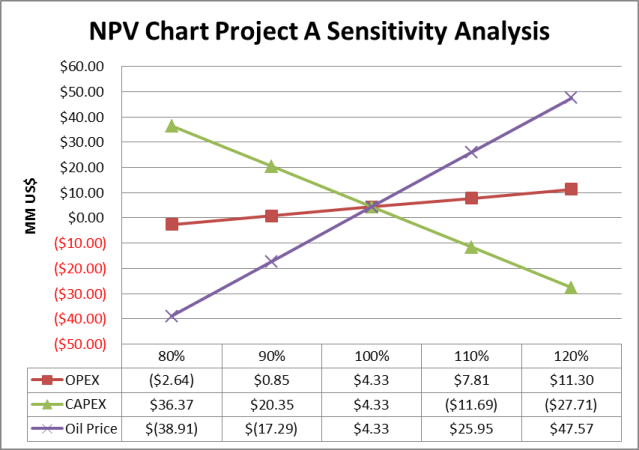

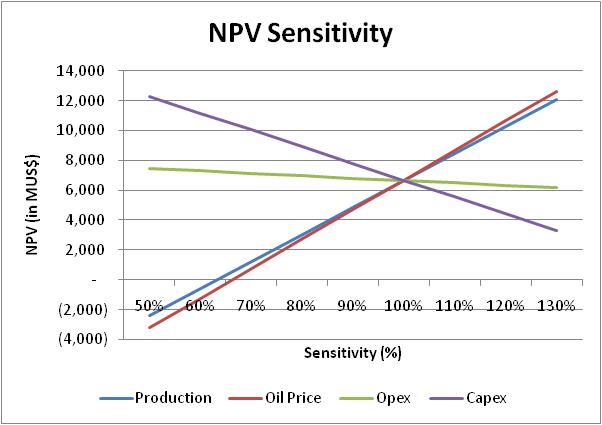

What is Sensitivity Analysis? Sensitivity analysis is a frequently used analysis tool in financial modeling that enables an analyst to gauge the impact of any changes in critical variables on the output.

Importantly, effective IRR management not only involves the identification and measurement of IRR, but also provides for appropriate actions to control this risk.

Sensitivity analysis – Free download as Word Doc (.doc), PDF File (.pdf), Text File (.txt) or read online for free.

SENSITIVITY TO MARKET RISK Section 7.1 Sensitivity to Market Risk (3/15) 7.1-2 RMS Manual of Examination Policies Federal Deposit Insurance Corporation

Deliver it fast, make changes deliver fast again, and fast again. Often analysis is a process of agreeing on assumptions with clients and investors. planEASe enables you to deliver a property analysis website seconds after the analysis is complete.

NPV Calculator is used to find the NPV of each alternative, so that you can chose the best investment for your money.

Real Estate Financial Modeling / 60-Second Skills / How To Build Awesome Sensitivity Analysis 2-Way Data Tables In Excel

Investment Appraisal Under Uncertainty – Sensitivity Analysis (example 1)

Advantages and disadvantages of internal rate of return are important to understand before applying this technique has certain limitations in analyzing certain special kinds of projects like mutually exclusive projects, unconventional …